Facts:

- Income tax payers are only 7-8% of the India total population (1.4 billion).

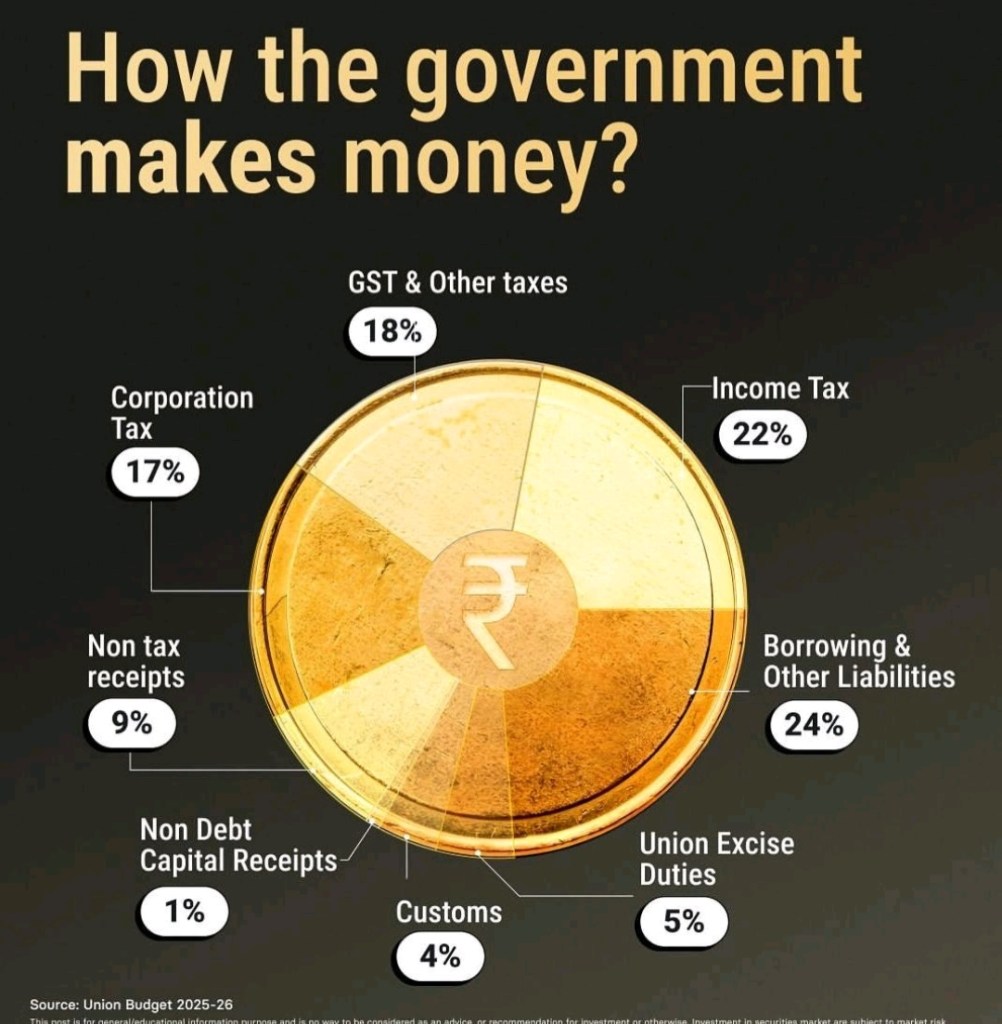

- Income tax contributes to 22% of total revenue collection.

- Govt now gives rebates to people earning till 12 lakhs of Annual income. People earning less than 12 lakhs are more than 90% of income tax payers.

- Everyone is paying indirect taxes or GST on goods/services purchase. They will be also paying taxes on buying fuel.

- India is left with less than 0.5% of total population paying income tax.

Expectations of Indian people:

- World class infrastructure like Good roads, Railways, Airports, highways, bridges etc

- World class Health care facilities like Hospitals, beds, machines, doctors etc

- Farmers need support in fertilizers, seeds, loans, storage etc

- World class tourism and cleanlines

- World class Defence and space facilities like weapons, Submarines, drones, aircraft, radar, missiles, satellites etc

- World class education like universities, R&D facilities, schools etc

- World class technology like quantum and super computers, AI, robotics, 3D printing, semiconductor, EV, Datacenter etc

- Zero corruption.

- People want to pay less taxes.

- People want free Health care facilities, free water, free electricity, free transportation etc

India is borrowing big money every year to boost economy and paying huge interest annually.

Open question:

- If we continue like this how many years will it take to fulfill people’s expectations.

- Will the country become a world super power if we continue giving tax rebate and freebies?

- What is essential for citizens and what all are the luxury given by the govt?

- What steps india is taking to become debt free country or reducing debt/GDP ratio?

- How can the government increase tax payers?

- What can we do with people who don’t want to pay income tax, gst, destroy public properties and expect high from the government?

- Are freebies and tax rebate creating a negative impact on people who are paying tax?

Leave a comment